Looking for liquidity? Here’s everything to know about NFT loans

With unprecedented demand for digital ownership creating a new and exciting asset class right before our eyes, the past 24 months have been a whirlwind for NFT enthusiasts. But eventually, all new toys lose their luster. And after a frenetic period of buying, selling and trading NFTs, investors look for new ways to leverage their assets.

Enter fractional ownership, staking, and the rise of NFT’s most popular new sector: loans.

You read that right. People are lending their comparatively-illiquid JPEGs for instant payments in crypto and cash. And it has become a huge sector of the market.

It’s finally time to break down the basics of NFT lending — how it works and the different lending models.

But first, a definition.

What is NFT debt?

NFT lending is the act of collateralizing your NFT as a loan in exchange for immediate crypto payments. And it solves the asset class’ most significant problem: liquidity. Compared to other asset classes, NFTs are relatively illiquid — meaning it’s not easy to quickly sell your NFTs for a fixed market price in cash (or cryptocurrency). In other words, it could take months for someone to buy your JPEG. Additionally, for investors with large investment allocations to NFTs, quick access to liquid capital can sometimes be a tall order. Loans provide NFT owners with a way to generate non-taxable income against the tax implications of a sale.

Here’s how it works: The borrower needs a loan and puts up an asset as collateral (NFT). Lenders provide loans in exchange for interest. But if the borrower is unable to repay the loan on the agreed terms, the lender will get collateral. In most cases, this process is performed autonomously through smart contracts on the blockchain.

But in all cases, NFT lending is done through one of four main models, each with its own advantages and disadvantages.

Peer-to-peer: NFT lending platforms made easy

The simplest form of NFT lending is peer-to-peer, as it closely resembles the relationship between a borrower and a lender that you would find at your local bank.

Most transactions take place on peer-to-peer NFT lending platforms such as NFTfi and follow a similar process. But unlike borrowing against an asset with a stable price, NFTs are a bit more complicated. market hall incredibly Volatile, which means that today’s market price of an NFT can be significantly different from the value down the line. So how do you assess its current value?

True, it depends. Most peer-to-peer transaction platforms use a simple offer system to allow anyone to lend and set terms without a centralized or third-party intermediary.

A user will list their NFT on the platform and receive a loan offer based on the lender’s perceived collateral value of the NFT. If the borrower accepts the offer, they will immediately receive an envelope of ETH or DAI from the lender’s wallet. Simultaneously, the platform will automatically transfer the borrower’s NFT to a digital escrow vault (read: smart contract) until the loan is repaid or expires. If the borrower defaults on the loan, the smart contract automatically transfers the NFT to the lender’s wallet.

Integrating multiple NFTs with Arcade and more

Other platforms such as Arcade allow users to aggregate or “wrap” multiple NFTs into a single collateral asset. Unlike NFTfi, Arcade allows borrowers to set their desired terms and repayment period in advance and then find a suitable lender match through the marketplace. Once a match is discovered, the process begins.

Bottom line? Peer-to-peer lending has emerged as the most convenient option for both borrowers and lenders, mainly due to its ease of use and security. The flexibility for both parties to set terms helps account for rare NFT features, and the smart contract logic within the escrow process is fairly straightforward. However, it is important to note that peer-to-peer lending may not be possible the fastest model, as it relies on a borrower finding a lender willing to mutually agree to set terms.

According to Richard ChenGeneral partner of cryptocurrency-focused investment firm 1 Confirmation, peer-to-peer lending is not only the safest model, but also the most liquid and competitive in terms of lending.

“If you list a CryptoPunk on NFTfi, you’ll get a dozen offers very quickly,” Chen said in an interview with nft now. As DeFi yields have fallen, DeFi lenders have shifted to NFT loans, as crypto has the highest yields at the moment.”

Peer-to-pool NFT lending

As the name suggests, peer-to-pool lending allows users to borrow directly from a liquidity pool without waiting to find a suitable lender match. To determine the value of parallel NFTs, peer-to-pool platforms like BendDAO use blockchain bridges (ChainLink Oracles, to be specific) to get floor price information from OpenSea and then allow users to access a set percentage of their NFTs floor price. gives An NFT-backed loan. The NFT is then simultaneously locked into the protocol.

When liquidation takes place, it is not based on repayment period. Instead, it occurs when the loan health factor — which is a numerical representation of the security that equates the market value of the collateral and the amount of outstanding loans — falls below a certain threshold. However, borrowers have 48 hours to repay the loan and recover their collateral.

Meanwhile, lenders who have provided liquidity to the liquidity pool receive interest-bearing BendETH tokens, which are priced one-to-one with the initial deposit.

In summary, With peer-to-pool lending, you gain speed but lose flexibility. Because these platforms set prices based on floor prices, owners of rare NFTs are disadvantaged, limiting the amount of capital they can access. The loan market is also very small. While platforms like Pine offer access to more NFT collections, BendDAO is only compatible with select blue-chip NFTs. But most importantly, there is a significantly larger platform and hacking risk than peer-to-peer, Chen said.

“Given the liquidity of NFTs, price oracles used in peer-to-pool can be used much more easily than in other tokens,” Chen said. To him, good NFT valuation tools like Deep NFT Value exist, but “there is still no Oracle infrastructure, so teams are running their own centralized Oracles that are prone to infrastructure hacking risks.”

Non-fungible debt positions

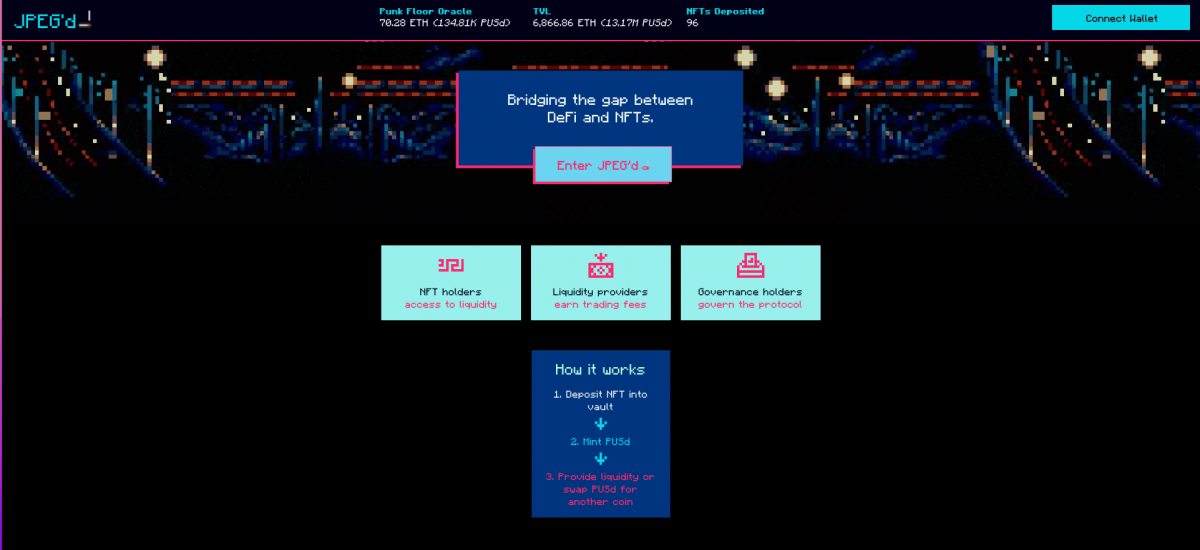

A spin-off of MakerDAO’s collateralized debt position structure, where borrowers additionally collateralize ETH (a risky asset) in exchange for DAI (a low-risk stablecoin), Non-Fungible Debt Positions offers a similar deal. But on NFDP platforms like JPEG’d, instead of depositing ETH in exchange for DAI, borrowers deposit selected blue-chip NFTs and in exchange $PUSd, a synthetic stablecoin pegged to USD.

Like peer-to-pool lending, JPEG’d uses custom chainlink oracles to fetch and maintain on-chain value data. Target? Integrating floor price and sales data with collateral value in real-time with high accuracy.

Non-fungible debt positions still exist very New, and needs to mature more before it can be considered a respectable lending model. To mitigate the volatility of ETH, loan positions deposited in MakerDAO are over-collateralized by 150 percent (or 1.5 times). NFTs are more volatile, and the lack of additional collateralization requirements raises some concerns about the unpredictability of the NFT market and future liquidations. In addition. JPEG’d is currently the only platform offering this framework, and it’s limited to CryptoPunks, so the available market is small, and the platform’s risk is quite high. All things considered, non-fungible debt positions should be closely scrutinized as they unfold.

NFT Rental and Leasing by Capital

Breaking ranks with the other three structures, NFT Rent allows NFT holders to lease their NFTs in exchange for upfront capital. Platforms like ReNFT work like peer-to-peer marketplaces, enabling renters and tenants to transact with different rental terms and agreements without waiting for permission.

Like the exchange in NFTfi, all rental transactions are facilitated through smart contracts. But instead of a borrower dedicating an NFT as collateral and locking it in a digital vault, the NFT is transferred to another person’s wallet for a specified period of time. In return, the “borrower” receives a lump sum of cryptocurrency. At the end of the predetermined period, the NFT is automatically returned to its owner. This is the simpler form of “loan”, as there are no repayment terms, interest, or liquidation concerns.

Unlike other forms of lending where lenders are rewarded by collecting interest, NFTs typically give lenders access and credibility. The NFT space thrives on social proof and owning an expensive NFT can increase attention and recognition in the space. Some communities are also token-gated, where renting NFTs helps users gain exposure and experience to people they might not otherwise have. Like renting clothes, cars, or other items of status-filled material, the emerging sector of NFT rentals is poised to become one of the most enduring.

Ultimately, whether NFT lending is the right decision for you depends specifically on your time horizon and risk tolerance. As with all crypto protocols, it’s essential to do your own research and not invest extra leverage or money you’re not comfortable losing.

https://ift.tt/fpmFdW5

Post a Comment

Post a Comment