How will Web3 shape the future of finance?

Web3 became more significant as its decentralized data storage capabilities improved. Users can now use blockchain and connected data to create a new generation of dedicated apps, allowing users to control who can access their personal information and where they can share it.

With decentralized technology, new computer advances and new economic sectors will emerge.

We’re analyzing Web3 and Blockchain financial trends to determine which industries will grow the most over the next 5-10 years. Web3 includes IoT and decentralized apps.

Blockchain, a peer-to-peer distributed ledger, stores cryptographically timestamped transactions in an immutable public database.

Emerging trends and macroeconomic forces

Initially, the decentralization of finance will be a significant development in Web3.

People are increasingly moving away from banks, causing a significant change in the financial environment.

In the digital money revolution, digital wallets like Coinbase, Circle and Xapo are leading the way They make it easy to hold and transfer funds. Greater control over their digital assets or the ability to sign smart contracts gives them more freedom. A single wallet service like Trust Wallet has over $25 million subscribers

In 2021, a total of $6.6 billion was invested in blockchain technology, and this amount is projected to grow to $19 billion by 2024.

In its most recent funding round, asset management company Andreessen Horowitz raised $4.5 billion from private investors. However, dApps (decentralized applications) and blockchain backbones will be supported using received cash.

The global cryptocurrency adoption rate has crossed the 4.0 percent threshold. According to Triple-A.

Cryptocurrency

In May 2022, stablecoins were one of the hottest topics. Bitcoin is the most well-known cryptocurrency, but stablecoins are the most popular.

For example, a “pegged” currency like a stablecoin is related to another currency or asset.

As a result, users can transact using digital representations of goods and currencies while maintaining price stability. The combined value of Tether, USD Coin, and Binance USD is around $150 billion.

Algorithmic stable coin

“Algo-coins” use mathematical methods to maintain accurate coin-to-asset ratios.

However, TerraUSD’s fall was the second largest algorithmic stablecoin crash of the previous year, followed by TITAN Coin’s -95% one-month loss in 2021. These two events eroded investor confidence in algorithmic stablecoins

Future progress

In conclusion, companies in Web3 will focus on making the blockchain network more user-friendly. Bitcoin’s Lightning Network and Ethereum 2.0 are two examples of enhancing the user experience so that when more people join crypto, they don’t have to worry about high transaction fees for small payments.

After that, the 2021 crypto craze brought a lot of newcomers. Over 10 million new crypto wallets have been established in the past two years and ICOs have raised $27 billion. Many developers and producers have jumped ship and joined the crypto revolution, benefiting the industry.

However, in the next two to three years, we expect that dApps, hardware wallets and other necessary protocols will be created that will repeat the cycle.

Banking or Finance

In 2021, decentralized banking grew by 1500% and in 2022, it used cryptocurrency to secure over $14T worth of transactions.

Another recent study shows that banks and insurance companies are using artificial intelligence to automate credit risk modeling and update how credit scores are calculated. This proves that AI is essential for asset management in the digital age.

Defy

Decentralized finance, or “DeFi,” refers to peer-to-peer (P2P) technology and encryption as an alternative to traditional financial institutions for sending and receiving money.

Open source platforms and technologies can help reduce the cost of financial services.

DeFi initiatives such as digital wallets, staking projects and smart oracles have the potential to grow significantly, according to a study by the Future Today Institute.

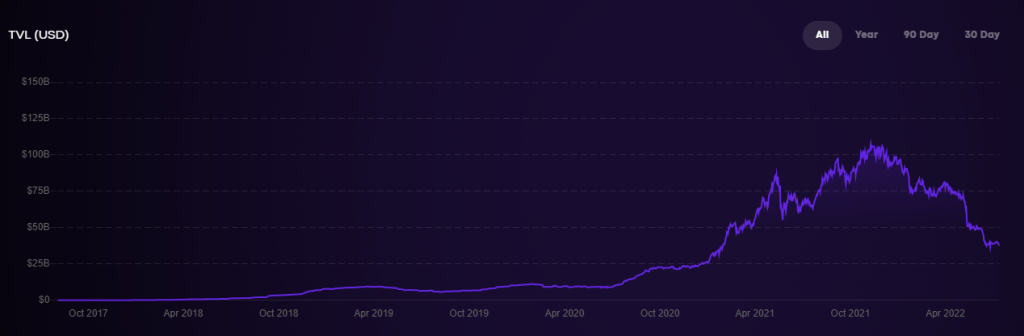

The growth of DeFi technology between October 2017 and May 2022 can be seen in this graph. After mid-2021, things are going to get a lot better!

Conclusion

If you’re looking for a way to get a head start on Web3 and DeFi, look no further: considering recent predictions that cryptocurrency mass adoption will increase to 10% by 2030, there’s a system that can handle the influx. This is important among millions of inexperienced users.

Initiatives that will gain traction in the next two to five years and serve as the foundation for the next wave of crypto and Web3 growth are digital wallets, upgrades to current blockchains, and the creation of new dApps and DeFi protocols.

NFTICALLY’s blogs provide in-depth guidance on various related topics. Above all, check out our FAQ or join our Discord or Telegram channels for 24/7 support with any NFT-related queries.

https://ift.tt/7gt1o4R

Related Posts

- See: Gary V explains the future of NFT

- The drama between comedian Comney and Goblintown became ugly

- How Metaverse will change consumer shopping

- Hxouse has launched its first Web3 tour in collaboration with Weekend

- Launches NFT Augmented Reality on Meta Instagram Storage and Launches Meta Pay

- Soland and Mango Market team together to handle $ 207M debt – The Defiant

Post a Comment

Post a Comment